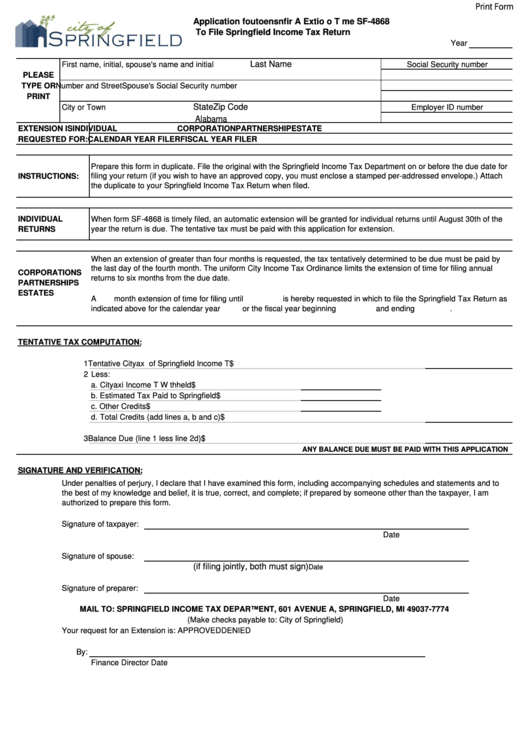

The IRS also has March 31, 2023, as the deadline for employers to file their annual Federal Unemployment Tax Return or FUTA. If these entities want to apply for a six-month extension, they can do that on the same date without attracting any penalties if they have already paid the correct amount of tax.Īlt text: Infographic entitled Tax Filing Extension Deadlines to Know, showing deadlines for individual tax returns, S-corps and partnerships, single-member LLCs and FUTA tax returns.įor single-member LLCs, the last date to file a tax return is also April 18, 2023, with the possibility of extending the deadline by six months to October 17, 2023. The tax filing deadline for 2023 for single filers, married couples filing jointly and heads of household is April 18, 2023.įor companies that are S-corporations or Partnerships, the deadline is March 15, 2023. What are the 2023 IRS tax extension deadlines? The penalties depend on how much tax you didn't pay and for how long. There's no penalty for extending your tax filing before the April 15 deadline, but not paying your estimated taxes will attract some harsh penalties. A tax filing extension doesn't allow you to delay your estimated tax payments it just buys you more time to file your annual tax return. In fact, there is no option to pay taxes late.

Many self-employed taxpayers often confuse it with an extension on paying their taxes, but they are not the same. The IRS gives taxpayers more time to file their tax returns by making a tax filing extension an option for anyone, no questions asked. If you can't make it in time for the 2023 tax filing deadline, the IRS will cut you some slack by allowing you a six-month tax filing extension. That's because you have to do everything from keeping records of your expenses to keeping track of all the necessary tax forms and all tax deadlines. No matter what your situation is, you can easily extend the deadline by getting a tax filing extension.įiling taxes on time is even more critical when you work for yourself as a freelancer, independent contractor or 1099 employee. Maybe you had a personal emergency, or the Silicon Valley Bank collapse disrupted your tax filing plans. Maybe you're still looking for the receipts for some business deductions you know you want to take. No matter how hard you try, circumstances can sometimes lead to you missing the IRS tax filing deadline.

0 kommentar(er)

0 kommentar(er)